PicksHyperliquid’s HIP-3: Synthetic US Stocks

📉Fee Compression

Growth Mode cuts taker fees by 90 percent. Per-asset activation by builders eliminates central gatekeeping. Effective cost: roughly 0.009 percent for takers per 1,000 USD traded; makers operate near 0.003 percent. This undercuts most centralized exchanges while running fully on-chain.

🏦Adoption Indicators

More than twenty synthetic tickers (AAPL, MSFT, META, PLTR, ...) with up to 20x leverage. OI caps expanded from 40M USD to above 50M USD as liquidity validated. Institutions such as Cumberland accumulate HYPE, positioning for the equity/FX TAM measured in trillions.

📈Volume

HIP-3 pushed Hyperliquid from a 100M USD/day venue to a 500M–540M USD/day engine. The 537M USD peak saw XYZ100 command 320M USD alone, with NVDA and GOOGL perps clearing more than 100M USD combined.

🛠️Architecture of Hyperliquid's Synthetic US Stocks

Synthetic Stocks on Hyperliquid are perpetual futures referencing off-chain equity prices through oracle feeds. They provide directional exposure, not ownership. All margining and settlement occur in USDC on the HyperCore engine.

Full Post about the road to synthetic assets: https://sosovalue.com/shares/5qK115

⚒️Deployment

A builder stakes HYPE, configures leverage ceilings (up to 20x), open interest limits (50M USD+), and oracle sources. Market makers maintain depth. Builders receive fifty percent of fees in perpetuity. No approval layer exists; listing is permissionless.

💵Oracle and Pricing

Equity spot prices update continuously through oracle networks. Funding rates maintain alignment between perp prices and spot. No expiry settlement; only funding transfers between long and short participants.

📀Trading Layer

Orderbook matching with ultra-low fees. Unified API with core perps. Traders deposit USDC and open leveraged positions 24/7 without KYC. Growth Mode rebates scale up with volume.

🛡️Risk and Enforcement

HyperCore executes margin, liquidation, and ADL systems. Builder bonds are slashable if oracle feeds fail or if liquidity deteriorates. This enforces discipline without centralized intervention.

🪄Settlement and Yield

All settlement is on-chain in USDC. Builders distribute fee shares to their stakers. The protocol routes ninety-nine percent of revenue into HYPE buybacks, constraining circulating supply.

Functional Outcome: a continuous, composable, globally accessible derivatives market.

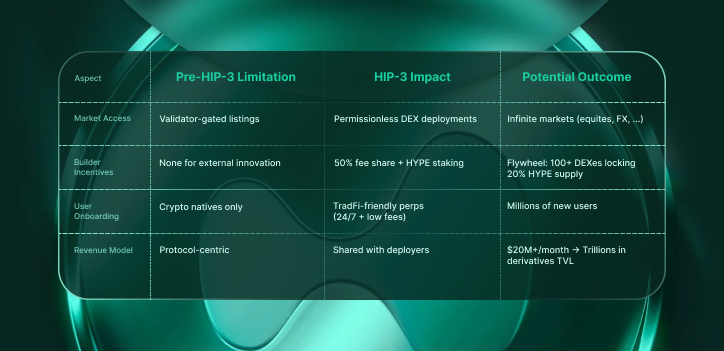

⚡The Potential: Before and After HIP-3

HIP-3 and hyperliquid's offering of US Stocks has the potential to change the future of Dexes, here is the impact it left...