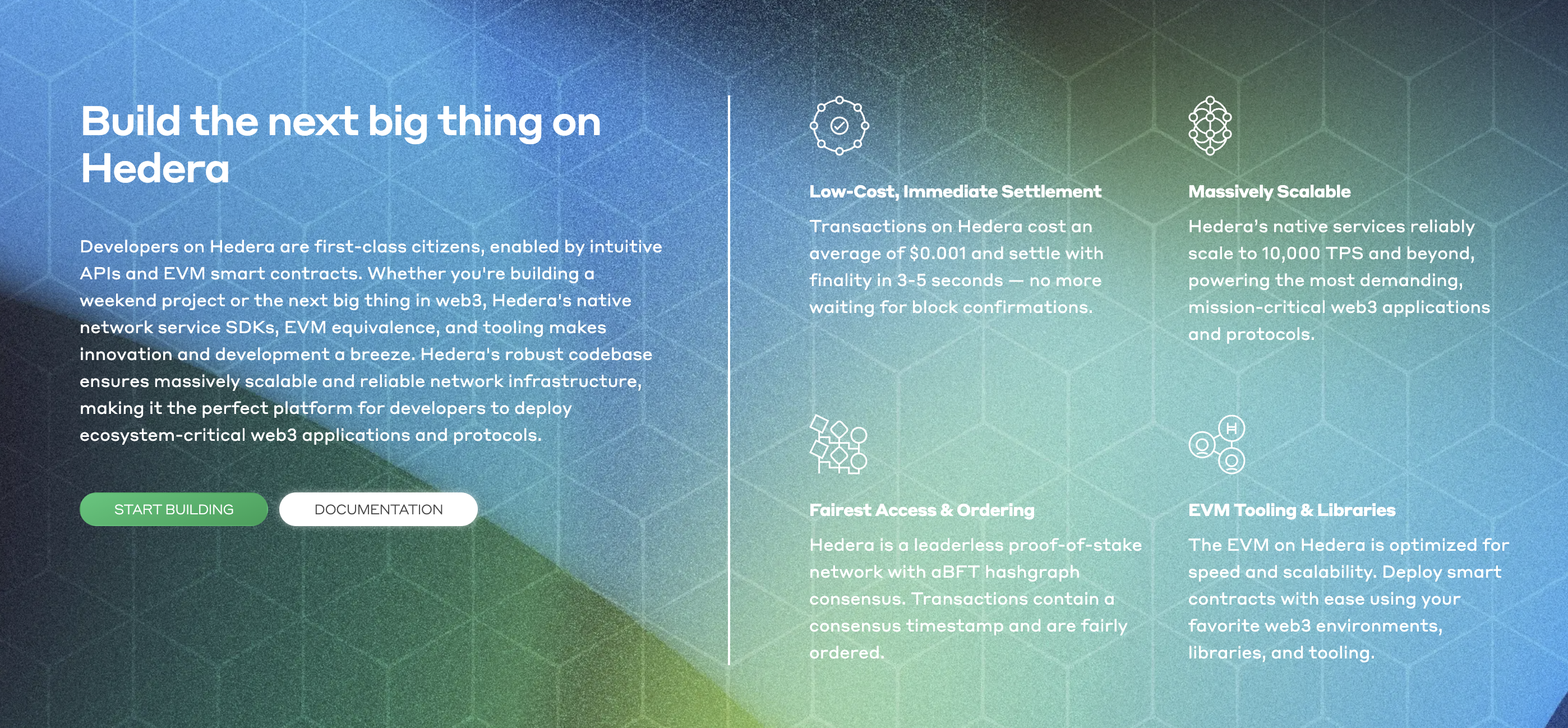

HBAR:Hedera Hashgraph uses a unique hashgraph consensus algorithm, offering faster transaction speeds and enhanced security compared to traditional blockchain technology. Its governance model is managed by a council of global enterprises, including Google, IBM, and Boeing, ensuring decentralized and stable network management.

XRP:Ripple is primarily used for cross-border transactions, utilizing a consensus ledger that offers faster processing speeds compared to traditional blockchain systems. The main users of the Ripple network are financial institutions, including major global banks such as Santander and American Express. Due to its low-cost and high-efficiency features, Ripple is widely used in the field of international remittances.

Key Takeaways

HBAR uses hashgraph technology, which offers faster transactions, lower fees, and higher energy efficiency compared to traditional blockchain technology.

XRP is focused on cross-border payments, working closely with banks and financial institutions to enable fast, low-cost global remittances.

Both HBAR and XRP are poised for growth in 2024, with HBAR being more enterprise-focused and XRP leading in the global payment space.

Key differences between HBAR and XRP

HBAR | XRP | |

Key features (Competitive advantages) | Governance model is managed by a council of global enterprises | Cross-border payments |

Transaction speed & Fees | 10,000+ TPS $0.001 per transaction | 1,500 TPS $0.0002 per transaction |

Long-Term Potential | Focused on enterprise and scalable applications | Focused on cross-border payments |

Supply | Total Supply: 50 billion Circulating Supply: 37.7 billion (75.4%) | Total Supply: 100 billion Circulating Supply: 56.8 billion (56.8%) |

Consensus algorithm | Hashgraph Consensus | XRP Ledger Consensus Protocol |

Performance over the past 5 years | Mean return: 243.38% Max: 1500.59% Min: -68.30% | Mean return: 79.64% Max: 523.26% Min: -53.25% |

Security | Byzantine Fault Tolerance | Trust-based validation |

Earning | Staking yield: 0.155% APY | Not available |

Adoption and Community Support | Partnerships with Google, IBM | Strong financial institution partnerships, wide recognition of remittances |

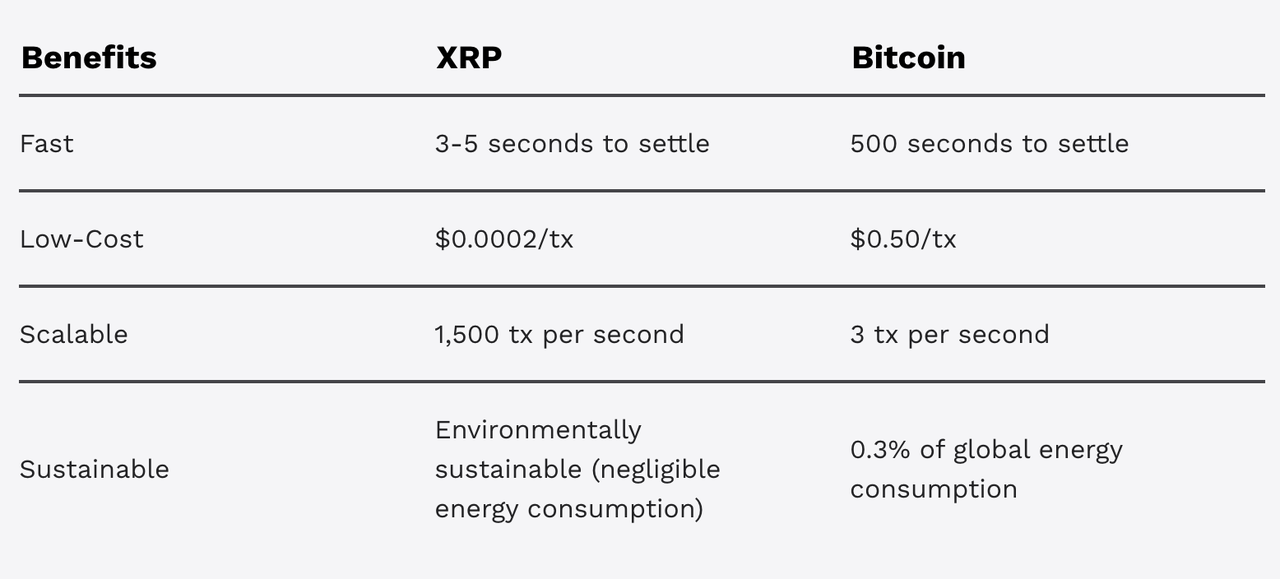

HBAR vs XRP: Transaction Speed & Fees

Transaction Speed:

HBAR (Hedera Hashgraph): Hedera’s Hashgraph consensus algorithm enables the network to achieve high throughput. According to Hedera's official documentation, the network reliably scales to 10,000 transactions per second (TPS) and beyond. This allows Hedera to support high-demand, mission-critical web3 applications with minimal latency, usually finalizing transactions within 3-5 seconds.

XRP (Ripple): XRP, through its RippleNet and XRP Ledger, is primarily designed for cross-border payments. XRP can handle 1,500 transactions per second (TPS) with an average transaction time of around 3-5 seconds. XRP’s focus is more on providing financial institutions with quick, reliable, and cost-effective international transactions, which explains its slightly lower transaction speed compared to HBAR, but still considerably faster than traditional banking systems.

Fees:

HBAR (Hedera Hashgraph): The average transaction fee on Hedera is just $0.001. This ultra-low cost makes it an attractive option for developers and businesses looking for scalable solutions that won’t incur high operational costs, especially in applications requiring frequent microtransactions.

XRP (Ripple): XRP is also known for its low-cost transactions, typically charging around $0.0002 per transaction. This makes XRP ideal for financial institutions that require fast and affordable cross-border payment solutions. Ripple's fees are actually much lower than Hedera’s, offering one of the most cost-effective solutions available in the blockchain space.

Comparation: HBAR processes up to 10,000 transactions per second, while XRP handles 1,500 TPS. Both finalize transactions in 3-5 seconds, but XRP offers lower fees at $0.0002 per transaction compared to HBAR's $0.001 per transaction, making XRP the more cost-effective option for cross-border payments.

HBAR vs XRP: Long-Term Potential

When assessing the long-term potential of HBAR (Hedera Hashgraph) and XRP (Ripple), it’s essential to focus on their technological innovations, use cases, partnerships, and ongoing developments rather than short-term price fluctuations. Below is a comprehensive comparison highlighting their respective strengths and future prospects.

1.Technological Foundations

HBAR (Hedera Hashgraph):

Consensus Mechanism: HBAR utilizes the Hashgraph consensus algorithm, which is known for its speed and efficiency. It allows for thousands of transactions per second (TPS) with low fees.

Governance: Hedera operates under a unique governance model where a council of reputable organizations manages the network, ensuring decentralization and security.

Use Cases: HBAR is designed for various applications, including decentralized finance (DeFi), non-fungible tokens (NFTs), supply chain management, and more. Its smart contract capabilities make it versatile for different industries.

XRP (Ripple):

Consensus Protocol: XRP employs a consensus ledger that allows for quick and cost-effective transactions, typically settling in just a few seconds.

Focus on Finance: Ripple primarily targets financial institutions and cross-border payments, aiming to facilitate faster and cheaper international money transfers.

Liquidity Provision: XRP functions as a bridge currency, enhancing liquidity for cross-border transactions and enabling institutions to hold less capital in various currencies.

2. Recent Developments

HBAR Updates:

Enterprise Adoption: Hedera has been actively partnering with major corporations and organizations to drive adoption. For instance, collaborations with companies like Google and Boeing indicate strong institutional interest.

Tokenization and NFT Initiatives: Recent developments in tokenization and NFTs on the Hedera platform highlight its growing ecosystem. The introduction of the Hedera Token Service (HTS) allows users to create and manage tokens easily.

Ecosystem Growth: The Hedera ecosystem is expanding with various projects in DeFi, governance, and identity verification, fostering innovation and attracting developers. In February 2025, Nasdaq filed with the SEC to list an HBAR ETF, signaling growing institutional interest in Hedera Hashgraph. And the SEC has accepted Grayscale's application for a Hedera (HBAR) spot ETF. This move was anticipated to attract more investors to the HBAR ecosystem.

XRP Updates:

Regulatory Clarity: The anticipation of a favorable resolution to Ripple's legal proceedings with the SEC further bolstered XRP's market performance. The market remains optimistic about XRP's future, given its recent regulatory approvals and ongoing legal proceedings.

On-Demand Liquidity (ODL): Ripple’s ODL service, which uses XRP for cross-border payments, has seen significant growth, with many financial institutions implementing this technology to streamline transactions.

Partnership Expansion: Ripple continues to expand its partnerships with financial institutions globally, enhancing its position as a leading provider of blockchain solutions for payments.

3. Market Position and Adoption

HBAR:

Growing Community: The Hedera community is rapidly growing, with numerous developers and projects building on its platform. Its unique selling propositions, such as speed and security, make it an attractive choice for developers.

Institutional Interest: Hedera’s partnerships with established organizations indicate strong institutional interest and a belief in its long-term viability. Hedera's increasing institutional interest, exemplified by ETF filings, positions it as a growing player in the blockchain space.

XRP:

Established Network: Ripple has built a robust network of banks and financial institutions, providing it with a solid foundation for long-term growth. Its focus on real-world use cases makes it appealing for large-scale adoption.

Market Leader in Payments: XRP’s strong foothold in the payments sector positions it well for continued growth, particularly as digital currencies gain acceptance in traditional finance. In December 2024, Ripple's stablecoin, RLUSD, received approval from the New York Department of Financial Services. This milestone enhanced Ripple's credibility and expanded its financial offerings.

Difference between HBAR and XRP in Supply

HBAR:

Total Supply: 50 billion

Current Circulating Supply: Approximately 37.7 billion (about 75.4% of total supply)

Future Supply: The remaining 24.6% will be gradually released over time

Inflation Rate: Currently 0%, but may change in the future

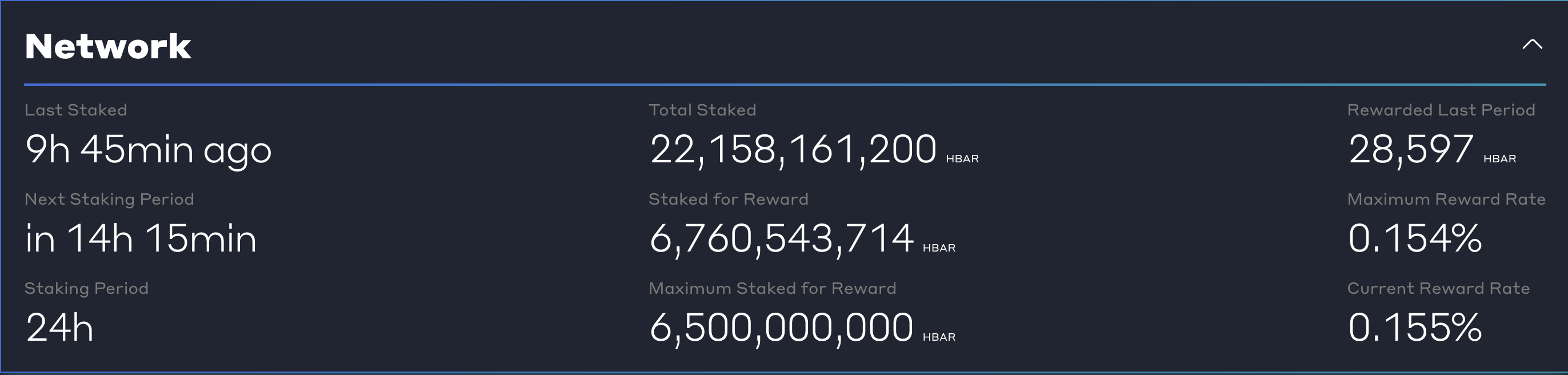

Staking Yield: 0.155% annual APY

XRP:

Total Supply: 100 billion

Current Circulating Supply: Approximately 56.8 billion (about 56.8% of total supply)

Future Supply: The remaining 43.2% will be gradually released over time

Inflation Rate: Approximately 0%

Staking Yield: Not available

Supply Comparison Table

Supply Metric | HBAR | XRP |

Total Supply | 50 billion | 100 billion |

Current Circulating Supply | 37.7 billion (75.4%) | 56.8 billion (56.8%) |

Future Supply | 25% | 43% |

Inflation Rate | 0% | 0% |

Staking Yield | 0.155% annual APY | Not available |

Summary HBAR and XRP exhibit distinct characteristics in their supply structures. HBAR offers a higher annual staking yield, while XRP is more widely used in payment and remittance applications. Understanding these supply differences is crucial for investors assessing the potential value and risks of these two cryptocurrencies.

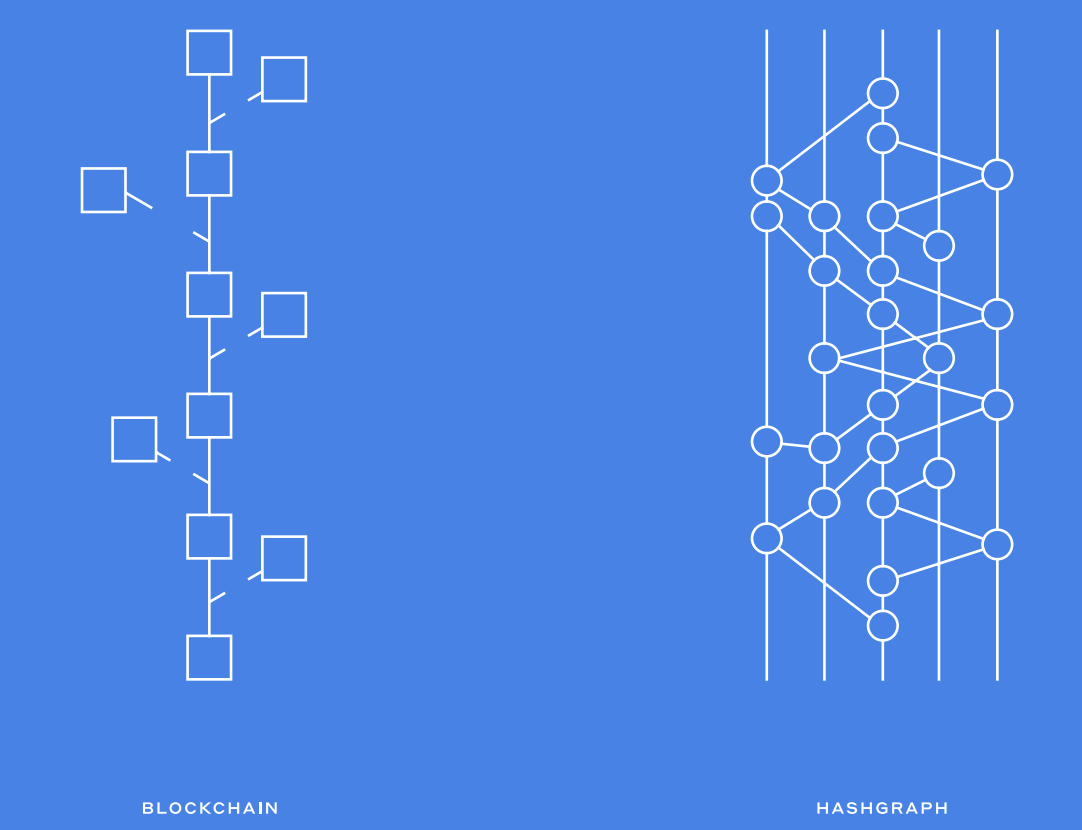

HBAR vs XRP: Consensus algorithm

1. Byzantine Fault Tolerance (BFT): The Hashgraph algorithm is highly secure, offering Byzantine Fault Tolerance, meaning it can tolerate a certain number of malicious or faulty nodes in the network without compromising its overall functionality. This guarantees the network’s ability to maintain accurate consensus even when some nodes act dishonestly.

2. Gossip About Gossip Mechanism: At the core of the algorithm is the "Gossip about Gossip" mechanism. In traditional gossip protocols, nodes randomly share transaction information with other nodes to spread knowledge across the network. However, in Hashgraph, nodes not only gossip about transactions but also gossip about who they gossiped with. This enables the network to build a full picture of the transaction propagation across the network, leading to efficient consensus formation.Nodes communicate by gossiping both transaction data and metadata about which transactions were shared with whom, forming a hashgraph that keeps track of the entire history of transactions.

3. Virtual Voting: One of the most innovative features of the Hashgraph algorithm is its virtual voting system. Unlike typical blockchain systems where nodes physically send votes over the network to confirm transactions, Hashgraph does not require actual votes to be sent. Instead, each node can compute how other nodes would vote based on the information they've already received via gossip. This greatly reduces the network overhead and makes the system faster and more efficient.

4. No Leaders, No Mining, No Proof-of-Work: Unlike blockchain systems that rely on leaders or miners to propose new blocks (as in Proof-of-Work or Proof-of-Stake systems), Hashgraph operates without a centralized leader. It uses a fair system where no one entity controls the order of transactions. There is also no mining process, making it significantly more energy-efficient.

5. High Efficiency and Low Latency: The Swirlds Hashgraph consensus algorithm is known for its high throughput and low latency. It can achieve transaction finality within seconds, usually in 3-5 seconds, without the need for multiple block confirmations. This makes it particularly suitable for real-time applications. According to Hedera’s official documentation, the Hashgraph network can handle up to 10,000 transactions per second (TPS), far surpassing most traditional blockchain systems.

6. Fairness: One of the key innovations in Hashgraph is its fairness. It ensures that no node or group of nodes can arbitrarily delay or reorder transactions. The transactions are processed in the order they are received, which is determined by the hashgraph structure and gossip protocol. Even if malicious actors attempt to manipulate the system, the algorithm ensures that the most fair and honest transactions are prioritized.

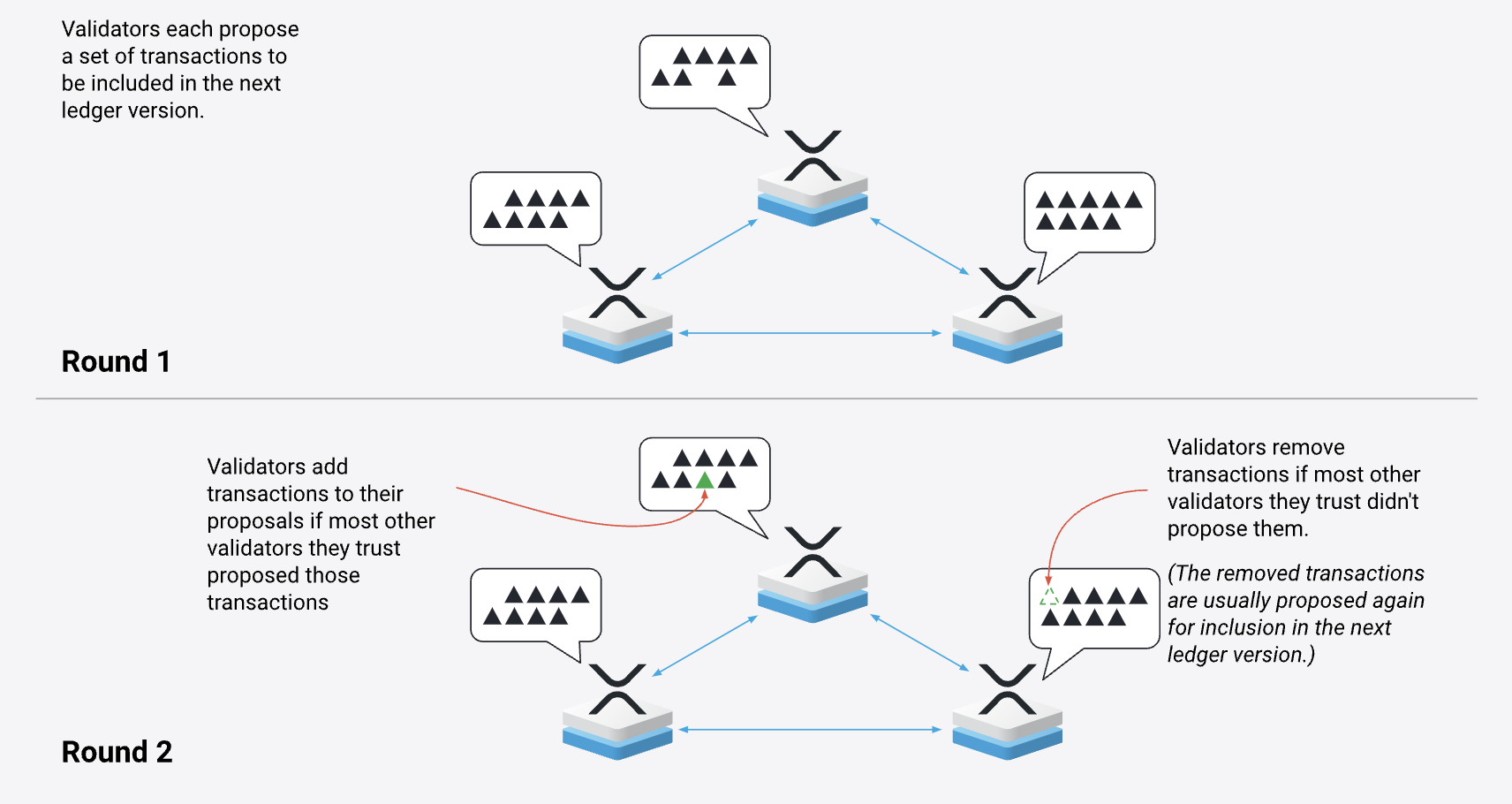

1. No Central Operator The XRP Ledger consensus mechanism operates without a central authority or single point of control. All valid transactions are processed by a distributed network of validators, ensuring decentralization and security.

2. Trust-Based Validation XRP Ledger's consensus relies on participants selecting a Unique Node List (UNL) of trusted validators. These validators coordinate to validate and agree on transactions, ensuring that the network runs securely without the influence of malicious nodes.

3. Fault Tolerance and Security The network can continue to operate as long as fewer than 20% of trusted validators are faulty or misbehaving. If more than 20% but fewer than 80% are faulty, the network halts but does not produce invalid transactions.

4. Resource Efficiency Unlike proof-of-work (PoW) systems, XRP Ledger’s consensus protocol does not require excessive computational resources. Consensus is achieved through validator proposals, making it more resource-efficient and cost-effective for transaction processing.

5. Orderly Consensus The primary goal of the XRP Ledger is to reach consensus on transactions in a specific order. Transactions are grouped into "ledger versions," and each new ledger contains the entire state of the network, meaning there’s no need to download the full history to understand the current state.

6. Double-Spend Protection The XRP Ledger consensus protocol effectively solves the double-spend problem by ensuring that mutually exclusive transactions are correctly ordered and only one transaction is confirmed.

HBAR vs XRP: Performance over the past 5 years

The performance of HBAR and XRP over the past five years shows significant variations in returns, influenced by market dynamics and the evolving cryptocurrency landscape. The following analysis outlines the comparative performance based on percentage returns.

Summary of Performance

HBAR: The mean return of HBAR is approximately 181.614%, with a maximum of 877.49%, indicating its potential for high growth, despite a minimum return of -68.21%.

XRP: The return has a mean of approximately 115.216%, with a maximum return of 277.68%. However, it also experienced a minimum return of -53.14%.

Performance Comparison Table

Metric | HBAR (Return in %) | XRP (Return in %) |

Count | 1825 | 1825 |

Mean | 181.614 | 115.216 |

Standard Deviation | 383.2 | 320.5 |

Minimum | -68.21 | -52.14 |

25th Percentile | -42.95 | 63 |

Median | 64.64 | 68.9 |

75th Percentile | 78.1 | 219.64 |

Maximum | 877.49 | 277.68 |

The data is selected from March 17, 2020, to March 17, 2025, with all calculations based on closing prices.

To conclude, both cryptocurrencies have undergone periods of rapid growth and significant corrections, reflecting the inherent volatility of the cryptocurrency market. XRP's substantial gains in early 2025 were closely linked to market anticipations of favorable regulatory changes under the Trump administration. HBAR's performance, while impressive, was marked by higher volatility, with sharp declines followed by recoveries.

Difference between HBAR and XRP in Security

HBAR (Hedera Hashgraph) Security:

Consensus Algorithm: HBAR uses Hashgraph Consensus, which is an Asynchronous Byzantine Fault Tolerant (aBFT) algorithm. The network uses a gossip protocol in which nodes exchange information about transactions in parallel (gossip about gossip). This allows the network to reach consensus quickly and securely without a single point of failure.

Byzantine Fault Tolerance (BFT): Hedera’s consensus is BFT, meaning it can tolerate up to one-third of nodes being compromised or malicious without affecting the accuracy of the ledger. In fact, even if some nodes act dishonestly, they cannot change the transaction order or outcome, ensuring immutability.

Security Strengths: Hashgraph’s virtual voting mechanism is highly resistant to malicious actors and provides mathematical guarantees that transactions will be finalized in a fair, secure manner. The decentralization of the council governing Hedera, including companies like Google and IBM, adds an additional layer of security governance.

XRP (Ripple) Security:

Consensus Algorithm: XRP uses the XRP Ledger Consensus Protocol, which relies on a trust-based validation system called the Unique Node List (UNL). Validators, chosen by network participants, verify transactions and ensure that only valid transactions are added to the ledger. As long as 80% of the trusted validators agree, the network can achieve consensus and finalize transactions.

Fault Tolerance: The system can tolerate up to 20% of validators behaving maliciously or going offline without affecting network performance. However, if more than 20% of validators are compromised, the network will halt rather than process invalid transactions.

Security Risks: Since XRP's consensus mechanism relies on trusted validators, security is primarily dependent on the integrity and honesty of these validators. There’s a slight risk if a large percentage of validators collude to act against the network's interests, although the protocol is designed to minimize this.

Comparison Table: HBAR vs XRP Security

HBAR (Hedera Hashgraph) | XRP (Ripple) | |

Consensus Algorithm | Hashgraph Consensus (aBFT, gossip protocol) | XRP Ledger Consensus Protocol (trust-based) |

Fault Tolerance | Up to 1/3 of nodes can be malicious (BFT) | 80% Validator Agreement Required |

Transaction Finality | Byzantine Fault Tolerant, secure finality | Achieved through validator consensus (UNL) |

Attack Resistance | Resistant to malicious attacks; mathematical guarantees | Validators must be trusted; risk of collusion |

Governance | Hedera Council with global enterprises | Community-selected validators |

Security Concerns | High decentralization, BFT ensures fairness | Validator trust & potential centralization |

Conclusion:

HBAR offers stronger security compared to XRP. HBAR’s aBFT consensus algorithm can tolerate up to 1/3 of nodes being compromised, while XRP’s consensus protocol can only handle up to 20% of validators misbehaving. This gives HBAR a clear advantage in terms of fault tolerance and resistance to attacks, making it the more secure option.

HBAR vs XRP: Earning

HBAR (Hedera Hashgraph):

Staking: HBAR operates on a proof-of-stake (PoS) network. Token holders can stake their HBAR tokens to help secure the network, receiving staking rewards in return. Current staking rewards for HBAR hover around 0.155% annual percentage yield (APY).

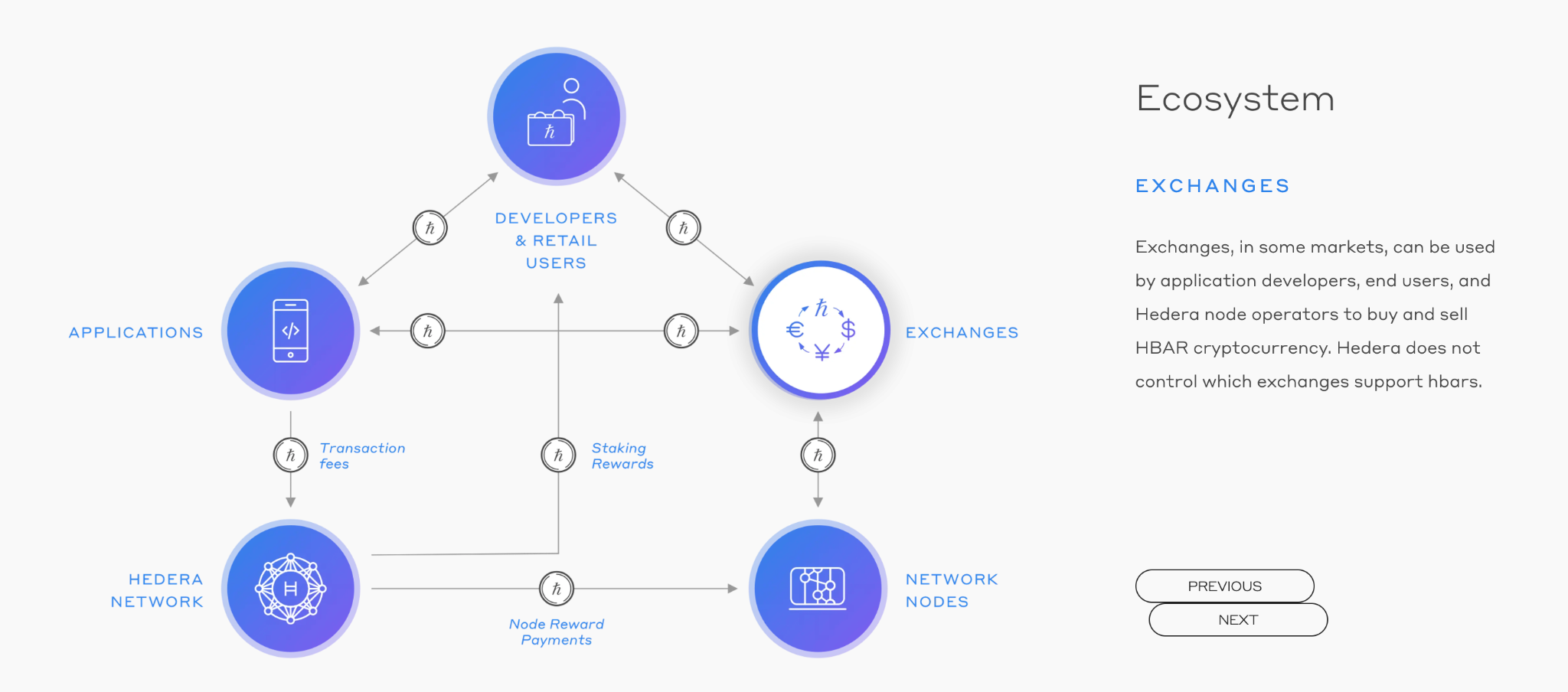

Network Participation: Developers and businesses can earn HBAR by providing services or creating decentralized applications (DApps) on the Hedera network. The more the network grows and is utilized, the more opportunities arise for developers and enterprises to build value within the Hedera ecosystem, earning HBAR in the process.

Transaction Fees: Additionally, HBAR can be earned as transaction fees from services that use the Hedera network, such as those generated through DApp usage and smart contracts. Users involved in the ecosystem may benefit from low fees while maintaining a stake in the platform's broader development.

XRP (Ripple):

Staking: XRP operates on the XRP Ledger, which utilizes a consensus protocol rather than a proof-of-stake (PoS) mechanism. Consequently, traditional staking is not applicable for XRP holders. However, some centralized platforms offer interest-bearing accounts where users can deposit their XRP and earn returns through lending services.

Network Participation: Developers and businesses can earn XRP by building applications or providing services on the XRP Ledger. The network supports various functionalities, including issuing tokens, facilitating payments, and creating decentralized applications (dApps).

Transaction Fees: The XRP Ledger charges a minimal transaction fee, typically starting at 0.00001 XRP (10 drops), which is destroyed (burned) to prevent spam and ensure network integrity.

HBAR vs XRP: Adoption and Community Support

Adoption Overview

Hedera Hashgraph (HBAR) has gained traction primarily within enterprise solutions, emphasizing speed and efficiency. Its use cases range from decentralized finance (DeFi) to supply chain management, attracting partnerships with major companies, including Google and IBM. HBAR aims to position itself as a go-to option for businesses seeking blockchain technology without compromising scalability.

XRP,developed by Ripple, is recognized for its focus on facilitating cross-border payments and remittances. It has established partnerships with numerous financial institutions and payment providers, showcasing its utility in real-world transactions. XRP's integration within the traditional banking sector enhances its credibility as a digital currency for financial services.

Real-World Usage

Both cryptocurrencies serve distinct purposes in the blockchain ecosystem:

HBAR: Used for transaction fees, smart contracts, and decentralized applications on the Hedera network. It is designed for high-throughput use cases, making it suitable for applications requiring fast and low-cost transactions.

XRP: Primarily used for remittance and settlement in cross-border transactions. XRP enables instant and cost-effective transfers between different fiat currencies, appealing to banks and financial institutions.

Market Capitalization Comparison

HBAR Market Cap: $7.9 billion (84.38% of Fully Diluted Valuation)

XRP Market Cap: $134 billion (58.26% of Fully Diluted Valuation)

HBAR vs XRP: Which one is better?

In summary, the comparison between HBAR and XRP reveals two distinct approaches to blockchain technology and cryptocurrency usage.

XRP stands out with its robust partnerships within the banking sector and widespread recognition for cross-border payment solutions. Its extensive community support further solidifies its position as a leader in the crypto space.

HBAR, while still growing, offers unique advantages with its enterprise solutions and fast transaction capabilities, making it appealing for businesses looking to leverage blockchain technology.

Ultimately, the choice between HBAR and XRP depends on the intended use case: XRP excels in payment solutions, while HBAR provides a versatile platform for various decentralized applications. For investors, considering factors like community support, market cap, and real-world usage can guide decisions on which asset to pursue in the ever-evolving cryptocurrency landscape.