Ethereum en 2025: Una evaluación estratégica del valor fundamental y los riesgos sistémicos

Part I: The Value Proposition Under Scrutiny

- To accurately assess the risks confronting Ethereum in 2025, it is imperative to first establish a clear and data-driven understanding of its foundational value. This value is a dynamic interplay of network activity, institutional capital flows, and its technological roadmap.

1.1 The Economic Engine: Network Activity and Ecosystem Dominance

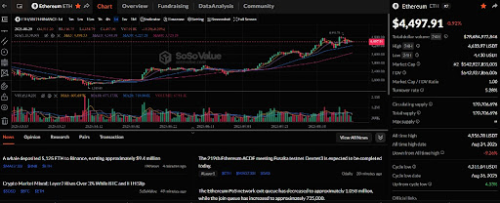

- Ethereum's intrinsic value is derived from its utility as a decentralized computational platform. As of 2025, its on-chain economy remains robust. It leads the Decentralized Finance (DeFi) sector with a Total Value Locked (TVL) of approximately $93 billion, representing 55% of the entire market. The network sustains high user engagement, with over 500,000 daily active addresses and 1.59 million daily transactions. The SoSoValue dashboard confirms this scale, showing a market capitalization exceeding $542 billion.

- Crucially, developer activity has remained strong despite market volatility. On-chain data from 2024 and 2025 shows a surge in the creation of new smart contracts, a metric historically correlated with positive price action. This resilient "developer moat" indicates long-term conviction in the platform's future, representing a vital, non-financial asset that has proven remarkably resilient to market stress.

1.2 The Institutional Catalyst: The Impact of ETF-Driven Capital Flows

- The launch of spot Ethereum Exchange-Traded Funds (ETFs) in 2025 has marked a paradigm shift in institutional engagement. August 2025 was pivotal, showcasing a strategic rotation of capital. While spot Bitcoin ETFs saw net outflows between $800 million and $1 billion, Ethereum ETFs attracted more than $4 billion in net inflows. On August 27 alone, Ethereum ETFs recorded +$307.2 million in inflows compared to just +$81.4 million for Bitcoin ETFs.

- This institutional demand is mirrored by "whale" activity, with the largest wallets accumulating an additional 1.44 million ETH in August. This trend reflects a growing understanding of Ethereum as a productive, yield-bearing asset due to its Proof-of-Stake (PoS) mechanism. This positions ETH as an instrument more akin to a dividend-paying stock, fundamentally altering its appeal for institutional portfolio managers.

1.3 The Scalability Revolution: The Fusaka Upgrade as a Value Multiplier

- Ethereum's value is critically dependent on executing its ambitious technical roadmap. The 2025 schedule, featuring the Pectra hard fork in May and the Fusaka hard fork in November, represents a strategic re-architecture of the network.

- The Fusaka upgrade is the main event, set to implement Peer-to-Peer Data Availability Sampling (PeerDAS) and Verkle Trees. These technologies are designed to dramatically increase data capacity for Layer-2s (L2s), enabling them to offer significantly higher throughput and lower fees, while also reducing the hardware requirements for running a network node. This solidifies Ethereum's pivot to a modular architecture, where it serves as the ultra-secure settlement and data availability layer for a vibrant ecosystem of specialized L2s, fundamentally reframing its competitive position against monolithic blockchains.

Part II: A Taxonomy of Risk: The Hidden Vulnerabilities in 2025

- While compelling, Ethereum's value proposition is counterbalanced by a complex set of technical, competitive, and regulatory threats that define its risk profile in 2025.

2.1 Technical and Security Risks: The Unseen Threats in the Code

- The Ethereum ecosystem operates in a relentlessly adversarial environment. In the first half of 2025, over $2.6 billion was lost to hacks and exploits across Web3, highlighted by the catastrophic $1.5 billion security breach of the Bybit exchange.

- At the protocol level, smart contract vulnerabilities remain a persistent challenge, while centralization vectors pose a systemic risk. The liquid staking protocol Lido controls approximately 28% of all staked ETH, raising concerns about potential censorship or a single point of failure. Furthermore, as Ethereum becomes more reliant on its L2 ecosystem, it inherits a new form of "complexity debt," where a vulnerability in a major L2's bridge or sequencer could lead to a catastrophic loss of user funds and a crisis of confidence.

Date (2025) | Incident / Metric | Type | Financial Impact (USD) | Description / Implication |

February | Bybit Exchange Hack | Centralized Platform Breach | ~$1.5 Billion | Largest ETH-related breach to date, highlighting third-party risk and potential for market contagion. |

H1 2025 | Aggregate DeFi Exploits | Smart Contract Vulnerabilities | >$2.6 Billion | Ongoing losses from reentrancy, logic errors, and oracle manipulation show persistent development security gaps. |

Q3 2025 | Lido Staked ETH Dominance | Centralization Vector | N/A | Lido controls ~28% of all staked ETH, posing a long-term risk to network neutrality and censorship resistance. |

Ongoing | Cloud Provider Concentration | Centralization Vector | N/A | High concentration of nodes on a few cloud providers (e.g., AWS) creates a critical single point of failure for the network. |

Ongoing | MEV-Boost Relay Centralization | Centralization Vector | N/A | A small number of MEV-Boost relays process a majority of blocks, creating potential censorship and control chokepoints. |

2.2 Competitive and Market Risks: The Battle for Supremacy

- Ethereum faces intense competition from alternative Layer-1 blockchains like Solana, which prioritizes high throughput and low transaction costs. However, a more subtle risk comes from within its own ecosystem.

- As L2s successfully absorb the majority of user activity, they risk starving the L1 of transaction fee revenue. A sustained decline in L1 fees could lead to lower staking yields, weakening the economic incentive to secure the network. This dynamic could also erode ETH's fundamental utility as "money" within its ecosystem. With the rise of Account Abstraction (ERC-4337), users may be able to interact with L2s using stablecoins for gas fees, diminishing the need to hold and use ETH for network operations. This could fundamentally alter its economic model and reduce the monetary premium that has historically contributed to its value.

Metric | Ethereum | Solana | Cardano | Avalanche |

Market Cap (USD) | $310 Billion | $85 Billion | $12 Billion | $11 Billion |

Transactions Per Second (TPS) | 15-30 (L1) | 2,600+ | ~1,000 | ~400 |

Monthly Active Addresses | ~15 Million (L1) | 86 Million (Total) | ~600,000 | ~1 Million |

Total Value Locked (TVL) | ~$93 Billion | $6 Billion | $225 Million | $1.07 Billion |

Average Transaction Fee (USD) | Variable ($1-$30+ on L1) | <$0.01 | ~$0.15 | ~$0.0 |

Note: Data reflects a snapshot from various points in 2025 to provide a comparative overview. Market Cap and TVL are highly volatile. Ethereum's active addresses and TPS are significantly higher when including its L2 ecosystem.

2.3 Regulatory and Compliance Risks: The Global Headwinds

- A complex and divergent global regulatory landscape poses a significant risk. In the European Union, the Markets in Crypto-Assets (MiCA) regulation is now in force, providing legal clarity but also imposing substantial compliance costs and strict operational requirements that may stifle innovation.

- In contrast, the United States continues to operate under a fragmented and uncertain regime, led by case-by-case enforcement actions from agencies like the Securities and Exchange Commission (SEC). This persistent uncertainty hinders institutional adoption and creates incentives for regulatory arbitrage, potentially leading to a geopolitical fragmentation of Web3. Navigating these diverging legal realities without compromising its core principles will be one of Ethereum's greatest long-term challenges.

Part III: Synthesis and Strategic Outlook

- The analysis of Ethereum in 2025 reveals an asset at a critical inflection point, defined by the immense potential of its catalysts and the substantial weight of its risks.

3.1 The Net Assessment: Balancing the Bullish Catalysts Against the Bearish Risks

- A consolidated judgment suggests that while the risks are significant, Ethereum's trajectory for the remainder of 2025 and beyond appears overwhelmingly positive. The fundamental drivers of institutional adoption and the technological leap of the Fusaka upgrade represent powerful, value-accretive forces that are likely to outweigh the prevailing headwinds. The rotation of institutional capital into Ethereum ETFs is a durable source of demand, while the Fusaka upgrade directly addresses the network's primary bottleneck. The combined momentum of these two forces provides a powerful tailwind likely to propel the ecosystem forward.

3.2 Key Signposts for Investors

- To translate this analysis into an actionable framework, investors should monitor a set of specific leading indicators through 2025 and into 2026.

Technical Signposts:

Fusaka Upgrade Execution: Successful and timely testnet deployment (Sept-Oct) is critical; delays or major bugs are a red flag.

Post-Fusaka L2 Activity: Monitor for a significant increase in L2 transaction volume and a reduction in average fees post-upgrade.

Bridge Security: A major exploit on a critical L2 bridge would signal a materialization of the "complexity debt" risk.

Market Signposts:

ETF Flows: Continued net inflows into Ethereum ETFs, especially relative to Bitcoin, would validate the "productive asset" thesis.

Staking Metrics: Track total ETH staked and the market share of providers like Lido. A decrease in Lido's dominance would be positive for decentralization.

User Migration: Compare active address growth on Ethereum L2s against rival L1s to gauge where new user adoption is concentrating.

Regulatory Signposts:

US Clarity: Any definitive ruling from the SEC on staked ETH or progress on the CLARITY Act would provide much-needed legal certainty.

MiCA Enforcement: The first major enforcement actions under MiCA in the EU will set an important precedent for DeFi protocols.

3.3 Concluding Thesis: Ethereum's Trajectory Towards a Global Settlement Layer

- Ethereum in 2025 is in the midst of a successful transition. It is shedding its identity as a slow "world computer" and cementing its role as the secure settlement layer for a global, multi-chain digital economy. The risks it faces are the inherent challenges of a technology maturing into a piece of critical global infrastructure. The powerful confluence of its entrenched network effects, a clear technical roadmap, and growing institutional recognition positions Ethereum to emerge from 2025 as the indispensable foundation for the future of finance and the internet.

Follow me and good luck! What should I do next?