deBridge

DBR

deBridge BasicReport a Data Error

deBridge Info

deBridge Team

deBridge Intro

deBridge is a decentralized interoperability layer designed to facilitate seamless cross-chain transfers of data, assets, and messages across various blockchain ecosystems. By leveraging an independent network of validators, deBridge ensures secure and near-instantaneous cross-chain transactions, eliminating the need for centralized intermediaries. This approach enhances the efficiency and security of decentralized finance (DeFi) applications, enabling developers to build interoperable decentralized applications (dApps) that can operate across multiple blockchain networks.

A key feature of deBridge is its dePort solution, which allows users to deploy tokens across supported blockchains in a non-liquid wrapped asset form. Additionally, the deBridge Liquidity Network (DLN) enables zero-slippage cross-chain exchanges without relying on liquidity pools, offering a high-performance and gas-efficient protocol for users. The platform also provides a customizable deBridge Widget, allowing developers to embed cross-chain exchange functionalities directly into their applications, thereby simplifying the integration process and enhancing user experience.

Since its inception, deBridge has attracted significant attention and investment within the blockchain community. In its seed funding round, the project secured $5.5 million, led by ParaFi Capital, with participation from notable investors such as Animoca Brands and Lemniscap. This financial backing underscores the industry's confidence in deBridge's potential to revolutionize cross-chain interoperability and drive the next wave of innovation in the DeFi space.

deBridge Unlock & AllocationReport a Data Error

Q&A about deBridge Tokenomics

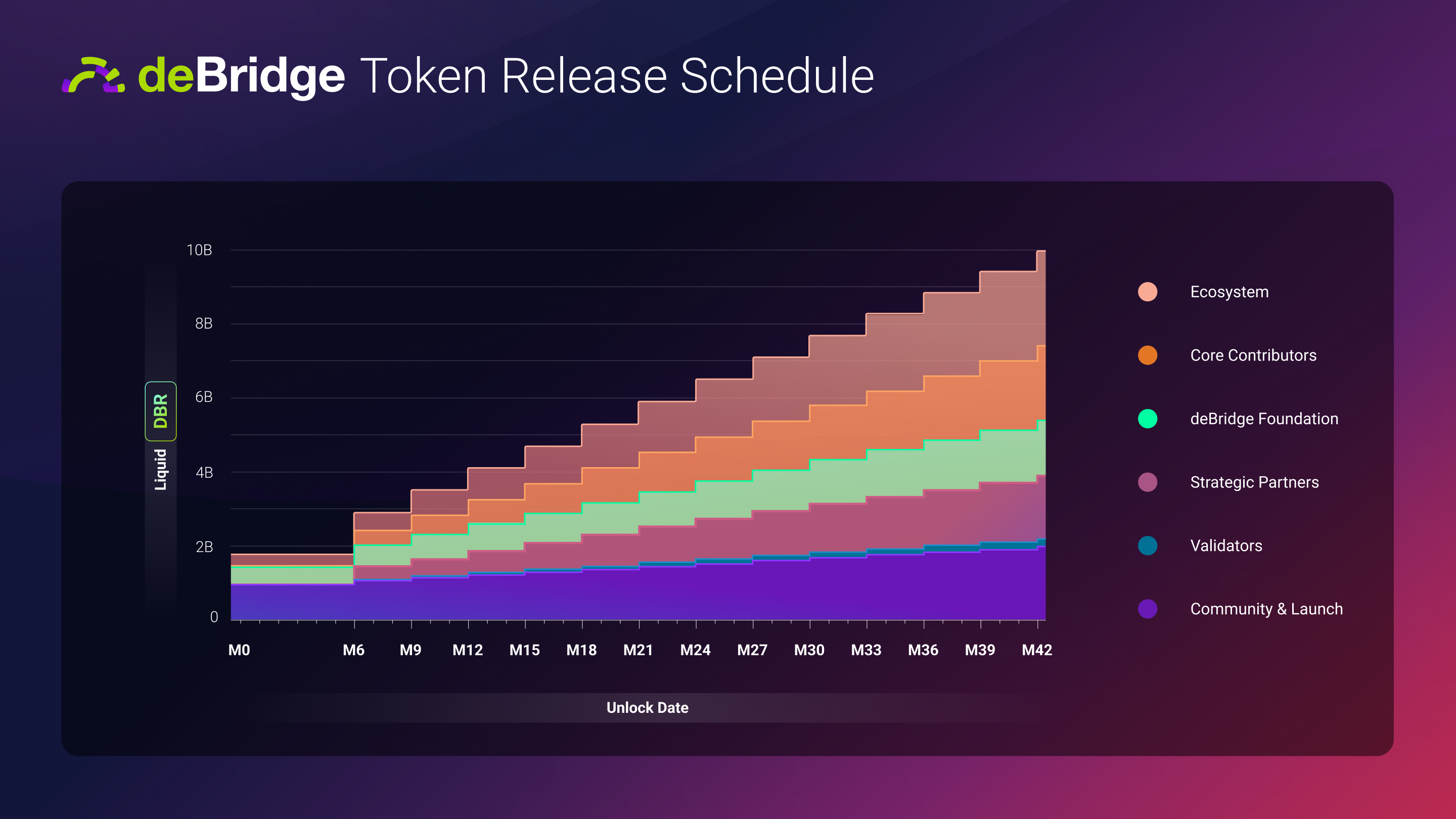

What's DBR's tokenomics?

Community & Launch

20% — 2,000,000,000 DBR

The deBridge community represented by users, developers and projects using our infrastructure is vitally important to the success of deBridge. This part of the token supply consists of several parts:

- Genesis community airdrop: this part is to be distributed to users and projects based on the future snapshot of Season 1 of deBridge points program.

- Launch-related activities (for example, Jupiter’s LFG launchpad in case deBridge is supported by the Jupiter DAO)

- Future distributions that will be performed through the next seasons of points campaigns

The exact percentages for each Community & Launch sub-parts will be announced at a future date after snapshot of Season 1.

1,000,000,000 DBR of the Community & Launch portion (10% of total DBR supply) will be unlocked at TGE and the remainder is subject to 3 year quarterly vesting, starting 6 months after TGE.

Ecosystem

26% — 2,600,000,000 DBR

This part of the token distribution will be custodied by the governance multisig and can be used with the approval of governance voting for ecosystem-level activities and incentives that bring value to the deBridge ecosystem. These include initiatives across developer community growth, community organizations, and more.

300,000,000 DBR of the Ecosystem portion, 3% of total DBR supply, will be unlocked at TGE and the remainder is subject to 3 year quarterly vesting, starting 6 months after TGE.

Core Contributors

20% — 2,000,000,000 DBR

This portion of the token supply is reserved for core contributors, who have worked for years across engineering, infrastructure, business development, security, marketing, and more to get deBridge to where it is today.

No DBR will be unlocked at TGE for the core contributors. 400,000,000 DBR (4% of total DBR supply) of the Core Contributor portion will be unlocked 6 months after TGE and the remainder will be vested quarterly over 3 years.

deBridge Foundation

15% — 1,500,000,000 DBR

This part of the supply goes to the deBridge Foundation treasury. It is to be used for growing the liquidity of DBR throughout the lifecycle of the token, and leading development of the protocol and growth of the ecosystem through various initiatives, such as grants and long term incentives programs.

The deBridge Foundation will be obliged to act in favor of the entire DAO, and its key participants including the core contributors, strategic partners, and the community.

500,000,000 DBR (5% of total DBR supply) will be unlocked at TGE and the remaining (10%) is subject to 3 year quarterly vesting, starting 6 months after TGE.

Strategic Partners

17% — 1,700,000,000 DBR

17% of the total supply of DBR has been set aside for strategic ecosystem participants including angels, founders, and funds who supported deBridge from the early days and helped to bootstrap the protocol before it became economically-sustainable and those who joined us later to enable strategic synergies and support the long-term success and growth of the deBridge ecosystem.

No DBR will be unlocked at TGE for the strategic partners. 340,000,000 DBR (3.4% of total DBR supply) of their stake will be unlocked 6 months after TGE and the remainder will be vested quarterly over 3 years.

Validators

2% — 200,000,000 DBR

Validators play a crucial role in maintaining operational resilience of deBridge cross-chain messaging, and they have performed tremendously with zero downtime incidents since mainnet launch 2+ years ago. This portion is a reward for their contribution, and a long-term incentive to continue their work for the ecosystem. The “deBridge validator” run by the core contributors for R&D purposes is excluded from this distribution.

No DBR will be unlocked at TGE for validators. 40,000,000 DBR (0.4% of total DBR supply) of their stake is unlocked 6 months after TGE and the remainder is vested quarterly over 3 years as long as they continue to demonstrate excellent and reliable performance, without forging or censoring transactions.

deBridge Token Allocation

People also watchReport a Data Error

deBridge Price Live DataReport a Data Error

deBridge is a decentralized interoperability layer designed to facilitate seamless cross-chain transfers of data, assets, and messages across various blockchain ecosystems. By leveraging an independent network of validators, deBridge ensures secure and near-instantaneous cross-chain transactions, eliminating the need for centralized intermediaries. This approach enhances the efficiency and security of decentralized finance (DeFi) applications, enabling developers to build interoperable decentralized applications (dApps) that can operate across multiple blockchain networks.

A key feature of deBridge is its dePort solution, which allows users to deploy tokens across supported blockchains in a non-liquid wrapped asset form. Additionally, the deBridge Liquidity Network (DLN) enables zero-slippage cross-chain exchanges without relying on liquidity pools, offering a high-performance and gas-efficient protocol for users. The platform also provides a customizable deBridge Widget, allowing developers to embed cross-chain exchange functionalities directly into their applications, thereby simplifying the integration process and enhancing user experience.

Since its inception, deBridge has attracted significant attention and investment within the blockchain community. In its seed funding round, the project secured $5.5 million, led by ParaFi Capital, with participation from notable investors such as Animoca Brands and Lemniscap. This financial backing underscores the industry's confidence in deBridge's potential to revolutionize cross-chain interoperability and drive the next wave of innovation in the DeFi space.